Introduction: Planning Today for a Secure Tomorrow

Building wealth for retirement is one of the most important financial goals adults face. While it’s easy to delay thinking about retirement, early and regular planning is crucial to ensure peace of mind later in life. A dedicated retirement investment services in Jaipur can provide the expertise and personalized guidance needed to navigate investment options, tax implications, and long-term wealth creation strategies successfully.

Maloo Investwise Pvt. Ltd., an experienced AMFI registered mutual fund distributor in Jaipur, is committed to helping individuals across North India meet their retirement goals with smart, customized plans. They offer some of the best investment services along with specialized portfolio management services in Jaipur that balance growth with risk management.

Why Do You Need a Retirement Investment Services Partner?

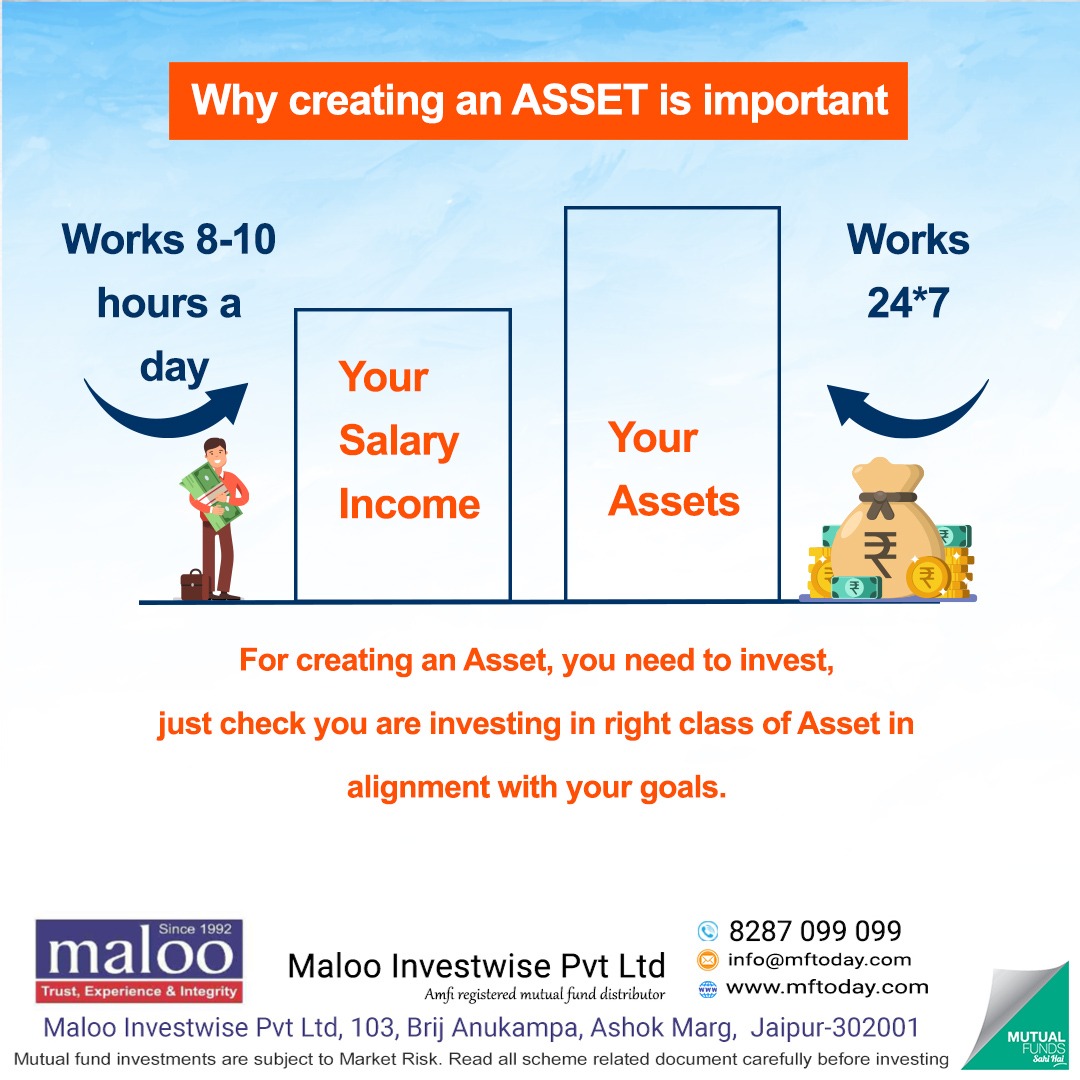

Retirement planning isn’t merely about saving money; it’s about aligning your finances with future life goals while managing uncertainties such as inflation, market volatility, and health expenses. Here’s how an advisor helps:

- Personalized Financial Goal Planning: Every individual’s retirement dream is different. A professional uses a financial goal calculator to identify the target corpus and timeline accurately.

- Customized Investment Solutions: They recommend suitable options across equities, debt, pension plans, and alternative investment funds based on risk appetite and market conditions.

- Tax Optimization: An expert ensures you leverage tax-saving instruments, making your retirement corpus more efficient.

- Regular Portfolio Review: Retirement planning is dynamic. The advisor monitors your investments and rebalances asset allocation to stay on track.

- Access to the Top Mutual Fund distributor of 2025:Working with reputed advisors ensures you get the latest insights and investment strategies.

Core Services Offered by Retirement Investment Services in Jaipur

Investment Services with Focus on Wealth Creation

A retirement expert provides detailed guidance to craft a diversified investment portfolio focused on sustainable wealth creation. Whether you prefer mutual funds, pension plans, or alternative investment funds, the advisor will align your portfolio with long-term growth goals while managing risks carefully.

Portfolio Management Services in Jaipur

Professional portfolio management takes the stress out of managing your retirement investments. Experts continuously monitor market trends and make tactical adjustments to maximize returns and secure your wealth against downturns.

Tax Efficient Strategies

Retirement income planning requires careful consideration of tax liabilities. Advisors recommend instruments offering tax benefits, such as Section 80C-compliant mutual funds and the best pension services in Jaipur that provide tax relief, enhancing overall post-retirement savings.

Why Choose Maloo Investwise Pvt. Ltd.?

We stand out as a trusted partner in retirement and wealth management. With comprehensive expertise in investment services and regulatory compliance as a registered AMFI mutual fund distributor in Jaipur, they ensure:

- Access to the best mutual fund investment service app for smooth and transparent investment tracking.

- Customized solutions that blend mutual funds, pension plans, and alternative investments.

- Support from the top mutual fund distributor of 2025, which applies data-driven insights and market expertise.

- Expert guidance tailored to North India’s unique financial landscape.

Practical Steps to Secure Your Retirement With Expert Guidance

Step 1: Define Clear and Realistic Retirement Goals

Before any effective plan can begin, it’s essential to have a clear understanding of what you want your retirement to look like. This includes considerations such as:

- Desired retirement age

- Expected lifestyle and expenses post-retirement

- Potential healthcare needs

- Travel or hobbies planned

- Family support responsibilities

A professional retirement investment service in Jaipur helps you put these pieces together, using a financial goal calculator to create a target corpus and savings roadmap that aligns with your aspirations and constraints.

Step 2: Choose the Right Investment Mix for Long-Term Growth

Wealth creation for retirement demands a diversified portfolio tailored to your timeline and risk tolerance. Your guide will recommend a blend of:

- Equity mutual funds for high growth potential

- Debt funds and fixed income securities for capital preservation and stability

- Pension Plans that offer regular payouts post-retirement

- Alternative Investment Funds to diversify beyond traditional assets

By working with top mutual fund distributors of 2025 and leveraging the best mutual fund investment service app, you can actively manage and review your investments to optimize returns while managing risks.

Step 3: Regularly Monitor and Rebalance Your Portfolio

Economic shifts, changes in market conditions, and your personal circumstances mean your retirement plan should be reviewed regularly. Your partner will:

- Assess progress against your retirement corpus goals

- Rebalance asset allocation, gradually shifting from equities to safer instruments as retirement nears

- Advice on tax-efficient withdrawals and reinvestments

- Help adjust plans for any life changes—new dependents, health issues, or changes in income

This proactive approach is key to staying on track and avoiding surprises when it’s time to retire.

Step 4: Ensure Tax Efficiency Throughout Your Investment Journey

Tax planning can significantly boost your retirement corpus. A knowledgeable advisor offers strategies to:

- Maximize benefits from Section 80C investments such as ELSS mutual funds and pension schemes

- Choose the Best pension services in Jaipur that qualify for tax rebates

- Structure withdrawals to minimize tax liabilities during retirement

- Plan for other tax-saving tools with long-term benefits

A reputed AMFI registered mutual fund distributor in Jaipur integrates tax planning directly into your portfolio strategy, enhancing overall returns.

Common Retirement Planning Mistakes to Avoid

Understanding what pitfalls to avoid can save you from serious setbacks on your retirement journey. Here are some mistakes many make—and how to steer clear of them:

Mistake 1: Starting Retirement Planning Too Late

One of the biggest errors is postponing retirement savings. Delaying even by a few years drastically reduces the power of compounding. Starting early—even with small amounts—allows your investments to grow steadily over decades.

Tip: Begin as soon as you get your first salary. If you’ve started late, increase your contribution rate or seek professional advice on accelerated growth options.

Mistake 2: Not Setting Clear Retirement Goals

Without a defined plan, it’s impossible to know how much to save. Vague or unrealistic goals lead to insufficient savings or overspending.

Tip: Use a financial goal planning calculator and work with your advisor to establish precise targets based on lifestyle and inflation projections.

Mistake 3: Ignoring Healthcare and Medical Expenses

Medical costs tend to rise as you age, often unexpectedly. Neglecting this in your plan can drain savings fast.

Tip: Include health insurance in your retirement plan and consider setting up an emergency medical corpus.

Mistake 4: Over-Reliance on a Single Income Source

Relying solely on one retirement income stream, such as pensions or a provident fund, can limit your financial security.

Tip: Diversify across mutual funds, annuities, rental income, or part-time work to build multiple income streams.

Mistake 5: Premature Withdrawal from Retirement Savings

Early withdrawals erode your principal and reduce your compounding power.

Tip: Have separate emergency savings to avoid dipping into your retirement corpus.

Mistake 6: Not Reviewing and Adjusting Plans Regularly

Markets and personal circumstances change. Neglecting periodic reviews risks misalignment with your goals.

Tip: Schedule annual or biannual reviews with your advisor, adjust asset allocation, and update goals as needed.

Mistake 7: Carrying Debt Into Retirement

Unpaid loans or credit card balances can strain fixed incomes.

Tip: Focus on clearing high-interest debts before retirement to ensure smoother cash flow.

Advanced Strategies to Maximize Retirement Wealth

Utilize Automated Investment Apps

Using the best mutual fund investment service app can simplify disciplined investing. Automated SIPs ensure regular contributions without emotional biases.

Explore Alternative Investments

While mutual funds remain key, alternative investment funds offer diversification opportunities that can enhance risk-adjusted returns over time.

Leverage Professional Portfolio Management

Engage in portfolio management services in Jaipur to benefit from expert market insights and tactical portfolio adjustments.

Why Maloo Investwise Pvt. Ltd. is the Ideal Partner

With extensive experience as a trusted AMFI registered mutual fund distributor in Jaipur, I help clients achieve through:

- Access to top-rated funds and pension plans

- Cutting-edge investment technology

- Guidance from the top mutual fund distributors of 2025

- End-to-end support from planning through retirement

Their comprehensive approach ensures your retirement wealth grows steadily, minimizes risk, and aligns fully with your evolving financial goals.

Conclusion:

Retirement planning is a journey that demands clear goals, disciplined investing, and continuous oversight. Partnering with a seasoned retirement investment services in Jaipur unlocks expert guidance, tailored strategies, and ongoing support to build lasting wealth. Begin your wealth-building journey today. Contact Maloo Investwise Pvt. Ltd., your trusted partner for retirement and investment services. Leverage expert insights, smart diversification, and cutting-edge tools to secure your financial future. Plan wisely, live comfortably! Don’t wait for the future to arrive unexpectedly. Act now by consulting and experience the confidence that comes from having a robust, tax-efficient retirement plan.

“Wealth is not just about how much you earn, but how wisely you plan, invest, and protect it for generations to come.”